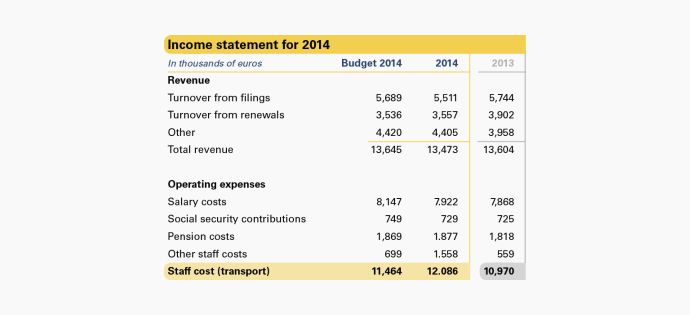

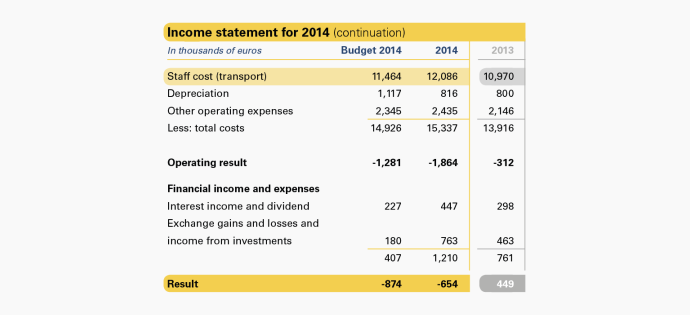

Summary financial statements 2014 - Income statement

Notes to the income statement

The BOIP recorded a negative result of EUR 654,000 (2013: EUR 449,000 positive). The decline in the result is attributable to a reorganisation involving a one-off expense of EUR 993,000 on account of lump sum redundancy payments, the continued payment of wages and outplacement costs.

- Revenue relates to the revenue derived from services rendered in the financial year. Revenues from services are recognised in proportion to the services rendered, based on the cost incurred in respect of the services performed up to the balance sheet date, in proportion to the estimated costs of the aggregate services to be performed.

- Staff costs at EUR 12,086,000 are clearly higher than in 2013 (EUR 10,970,000) on account of reorganisation costs.

- The cost price of these services is allocated to the same period. If the bottom-line result of a service cannot be determined in a reliable manner, but is expected to be positive, only the revenue amounting to the sum of the costs is recognised. If these costs cannot be reliably determined, revenues are not recognised in the interim period but on completion of the service. However, the costs already incurred are recognised in the income statement.

- The BOIP has a defined contribution pension scheme and pays the contributions to Aegon, the pension administrator, on an annual basis.

- Turnover decreased to EUR 13,473,000 compared with EUR 13,604,000 in 2013 due to lower turnover from filings (EUR 233,000) and renewals (EUR 345,000) which was offset by higher other revenues (EUR 447,000). Mainly turnover from patents rose (EUR 209,000) and CaribIE (EUR 176,000).

- At EUR 816,000 depreciation costs (2013: EUR 800,000) remained almost unchanged.

- Other costs rose in the financial year to EUR 2,435,000 (2013: EUR 2,146,000) on account of higher hosting costs for the patent collaboration (EUR 229,000) and consultancy costs arising from the amendment of the Headquarters Agreement (EUR 161,000). Legal costs decreased to EUR 76,000 (2013: EUR 135,000).